r&d tax credit calculator 2020

With just a few clicks - we can estimate your refund. If you would like a detailed analysis of the potential benefits or.

R D Tax Credit Calculation Adp

The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years.

. File the RD tax credit on Form 6765 Credit for Increasing Research Activities which is a part of your 2020 annual corporate form 1120 US Corporation Income Tax Return. Because it is taxable the cash benefit youll receive is 11 after tax. RD Tax Credit Estimating Tool.

01633 860 021 hellozesttax. For startups applying the credit against payroll taxes is a valuable non-dilutive funding opportunity. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

This calculator has been developed utilizing data from a variety of studies conducted in the industries listed. What types of activities qualify for the RD Tax Credit. RD TAX CREDIT CALCULATOR.

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion for corporations and 12 billion for individuals. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. This is a dollar-for-dollar credit against taxes owed.

This result in this case is 7500. We only charge IF we determine you are entitled to a tax credit. You can then offset the RDEC against your tax bill or where there is no tax payable you will receive the net amount as cash.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Of supplies used in RD. Code 41 Credit for increasing research activities Under this provision of law a portion of the expenditure incurred by the taxpayer in carrying on research R D.

The Tax Credit Calculator is indicative only and for information purposes. Then youll need to have the following figures on hand. 4 The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA.

RD Tax Credit Calculator Nick Tantillo 2020-02-12T2354170000. What expenses qualify for the research. RD Tax Credit Calculation.

Enter Current Year Total Wages Average Annual Growth over prior 3 years Projected net federal credit. Of Employees involved with RD. Claim your R.

RD Tax Credit Calculator. The results from our RD Tax Credit Calculator are only estimated figures and actual numbers will vary depending on the specific circumstances of the business. Our experienced tax team will analyze your investment in new technology development to help you get real non-dilutive cash back into.

Plus it carries forward 20 years. Total number of employees in your business. Estimate Today With The TurboTax Free Calculator.

Max refund is guaranteed and 100 accurate. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. We will show you how.

The current rate for the RDEC is 13. Start Your Tax Return Today. This is only an approximation based on a variety of assumptions and should be treated as such.

Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Contact Strike to know exactly how much you. For Technology Ecommerce Bio-Tech Industries More.

Greater of base amount or 50 current QREs. Tax credits calculator - GOVUK. This is a dollar-for-dollar credit against taxes.

Need help filing for your RD Tax Credit. Total Amount spent on 3rd Parties involved with RD. It was increased to.

Ad All Major Tax Situations Are Supported for Free. For example if you spent 200000 on RD last. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Free means free and IRS e-file is included. What is the RD tax credit worth. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Youll need to work with your payroll processor to make this happen. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Call us at 208 252-5444.

For most companies the credit is worth 7-10 of qualified research expenses. 12 from 1 January 2018 to 31 March 2020. RD Tax Credit Calculator.

Enquire now so Lumo can fully optimise. The RDEC is paid as a taxable credit of your RD costs. Ad No More Guessing On Your Tax Refund.

In RD tax relief based on the RD tax credit rates as of 1. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. If your business is spending money to create a new product or process or improve upon an existing product or process then.

Find out how much your business could be due using our free RD tax credit calculator. RD Tax Credits Calculator. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

The RD tax credit calculation can be done under the regular research credit method or the alternative simplified credit. The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. It should not be used as a basis for calculations submitted in your tax returns.

Rdec Scheme R D Expenditure Credit Explained

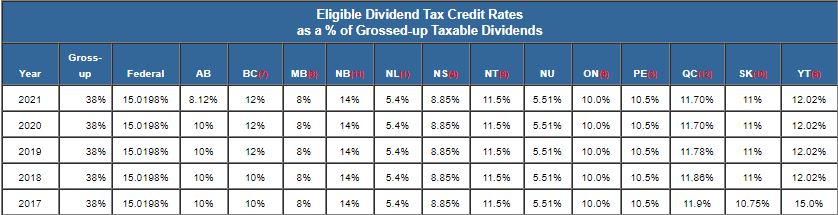

Taxtips Ca Dividend Tax Credit For Eligible Dividends

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Credit Calculator Sunnybrook Foundation

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Examples Mpa

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

R D Tax Credit Calculation Adp

A Simple Guide To The R D Tax Credit Bench Accounting

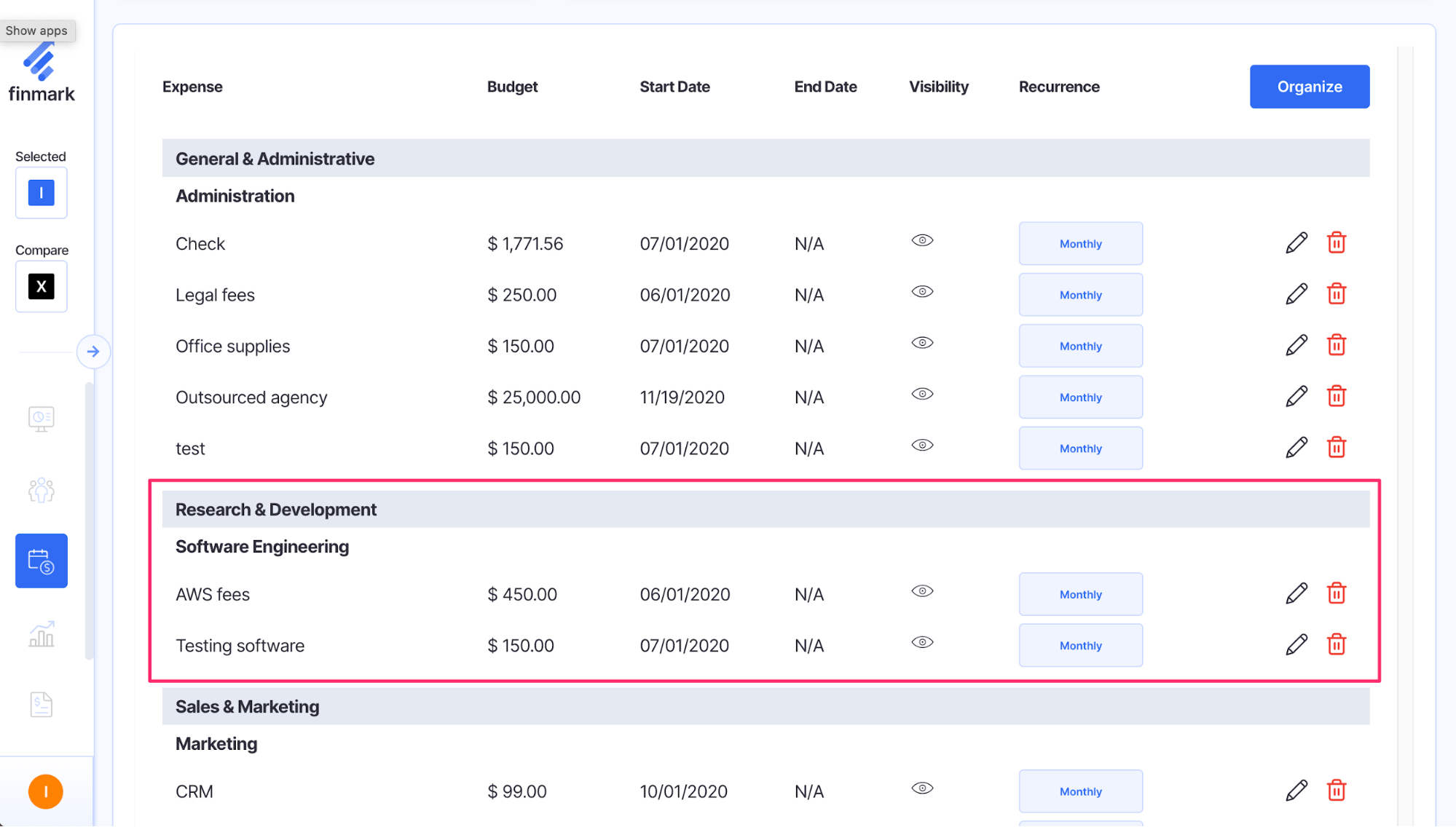

Research And Development Expenses R D Expense List Finmark

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Easy Solar Tax Credit Calculator 2021

Manitoba Tax Brackets 2020 Learn The Benefits And Credits